Every year, each member of the Plan pays a small Annual Administration Charge to cover the running of the Plan, like its administration, communication, ongoing governance and more.

The payment is taken automatically from your pension account each January. The charges need to be at a sustainable level, as well as continue to provide good value for money. Next year, how the charge is calculated will be changing so that the same fee structure is provided to all members.

You also pay an annual investment management charge. Legal and General Investment Management (LGIM) has been appointed by the Trustee to manage the investment of your pension account. LGIM charge for this service; the charges are accrued on a daily basis throughout each quarter and reflected within the unit price for each fund.

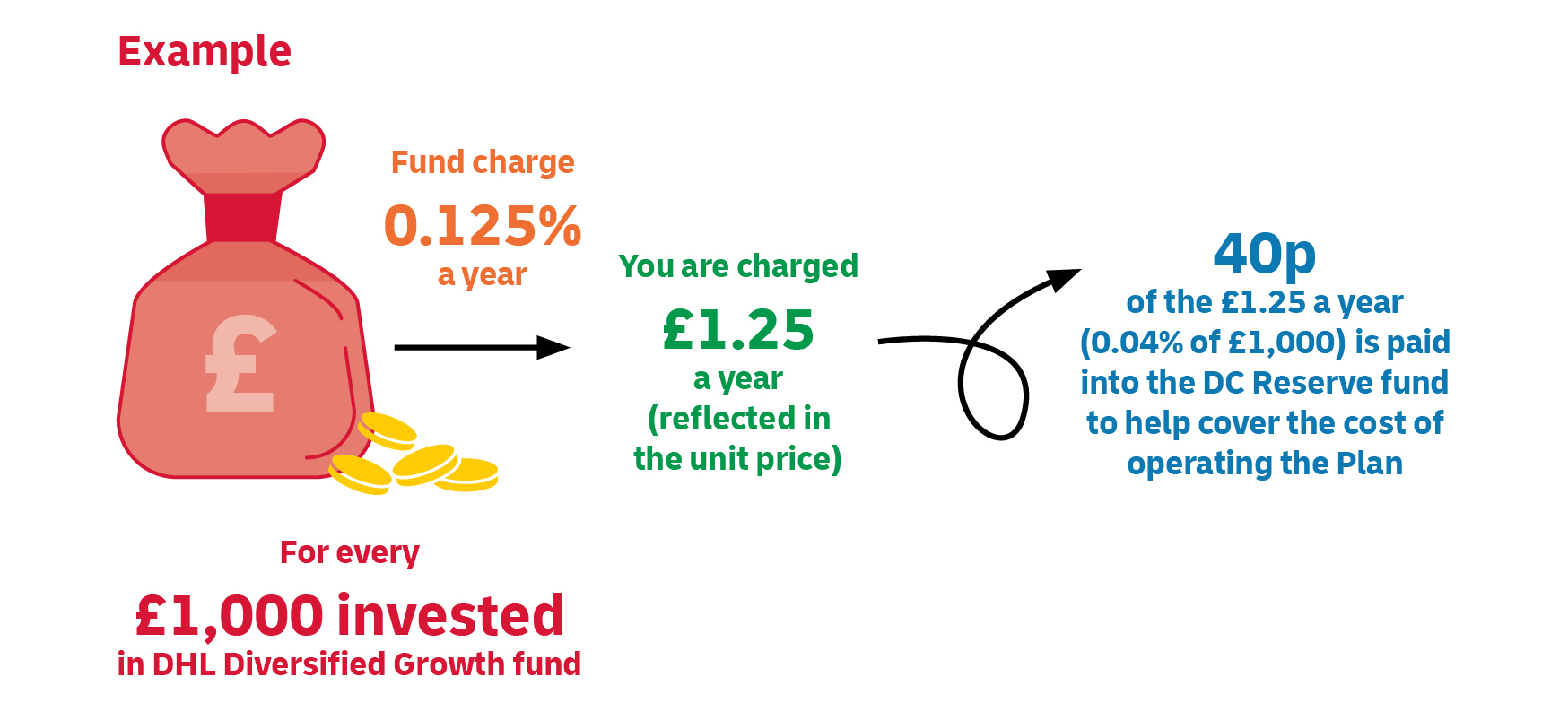

For example, the charge for the DHL Diversified Growth Fund is 0.125% of fund value per year, which means that for each £1,000 invested in DHL Diversified Growth Fund the investment management charge is £1.25 per year. This is recovered through an adjustment to the unit price of the fund (so in other words this is automatically reflected in the value of your fund holdings). 0.04% of the investment management charge is paid into the DC Reserve Fund to help pay for the costs of running the Plan.

The current investment charge levied by LGIM on the funds will not be changing.

Why are we changing the fee structure?

The Trustee has reviewed the Plan charging structure carefully by benchmarking against other large pension schemes and ensuring that the revised charges still represent good value for money. The Trustee also believes the new structure is more straightforward for members to understand and simpler for us to administer as well.

The new approach is more consistent as it ensures that all members pay the charge as a fixed percentage of their whole account, regardless of the size of their pension account.